We’re not gonna take it

No, we ain’t gonna take it

We’re not gonna take it anymore

– “We’re Not Gonna Take It”, Twisted Sister

After a week of equity and bond markets being whipsawed by positioning, economic narratives, and Fed expectations, it is helpful to take a step back, “cut through the noise” (as Bloomberg’s Tom Keene would say), and focus on the fundamentals.

We are nearly finished with 2Q24 earnings season, with 455 of the S&P 500’s stocks having reported results.

On the surface, this earnings season was solid, with 78% of companies beating on earnings (this is roughly in line with the historical average beat rate calculated by FactSet). Earnings growth came in at a healthy +11.5% for 2Q24, better than the 8.9% expected prior to the reporting season.

The source of these beats appears to be from companies “controlling what they can” on factors like cost and capital allocation (and, arguably, accounting), given revenue growth was less of a source of upside surprise, with only 56% of companies beating on this metric.

These revenue results paint an interesting story about the state of the U.S. economy and U.S. consumer, a story nearly as epic as Mark Metcalf getting blown out of a window by an electric guitar and a child spin-morphing into Dee Snider.

“We’re Not Gonna Take it Anymore”: Consumers Pushing Back on Price Increases

From a consumer perspective, the past four years have been brutal for price increases.

Since the start of 2020, the price level for all goods and services is +22.3% (CPI), while food prices are up +27%, goods prices (ex food and energy) are +16%, and services prices (ex shelter) are +20%.

Initially, consumers had no choice but to take these price increases in stride. Demand was robust for goods coming out of the pandemic, while supply chains were still gnarled by shutdowns, meaning consumers had little power in pushing back against price hikes (remember all those cars bought well above MSRP!).

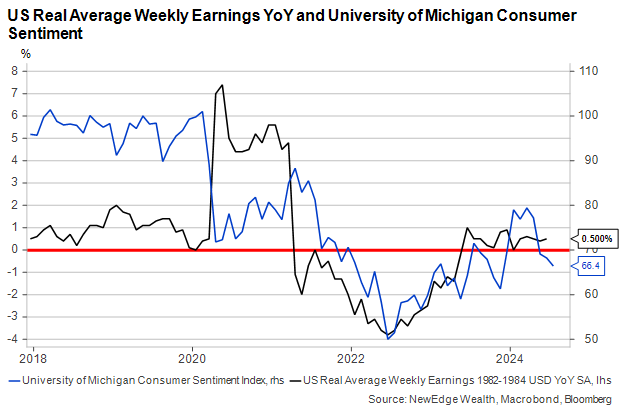

Consumers also had more capacity to absorb higher prices, with fiscal support, excess savings, and strong wage gains. They didn’t feel great about the price increases, as seen by consumer sentiment surveys being in the doldrums for the past four years, but they still found ways to spend on what they needed and wanted.

But over the last few quarters, there has been a shift in this pricing power dynamic. Where companies reported (and enjoyed!) strong pricing power into 2023, this pricing power has been fading as consumers push back.

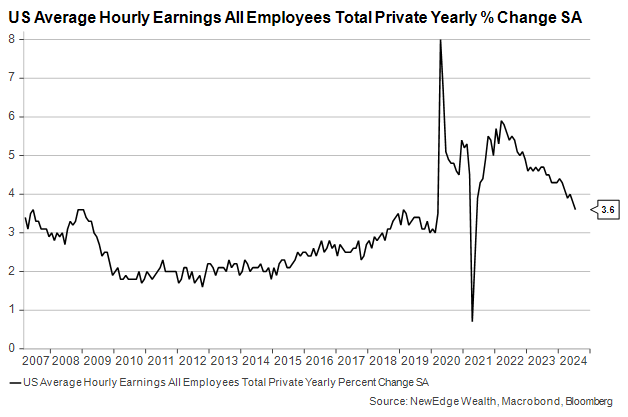

This pushback is made possible by improved supply of goods and services, opening up for greater choice and, potentially, competition on price. The pushback is also due to consumers becoming increasingly strained, mostly in lower income cohorts, as excess savings are exhausted and wage growth slows.

This dynamic made the key theme from this earnings season for consumer-facing companies the meaningful slowdown in the ability for these companies to raise prices further, along with a stark bifurcation in the experience of high-income and low-income consumers.

“Your Call is Never Ending”: What Companies are Saying About Price and Demand

From burgers, to theme parks, to airlines, to retailers, the message from consumer facing companies this quarter was about price sensitivity, trade down (opting for lower price choices), and a bifurcation between high and low income consumers.

Here are a few examples:

Amazon (AMZN): “We’re seeing lower average selling prices or ASPs right now because customers continue to trade down on price when they can. More discretionary higher ticket items, like computers or electronics or TVs, are growing faster for us than what we see elsewhere in the industry, but more slowly than we see in a more robust economy.”

McDonald’s (MCD): “As we absorb these cost increases in partnership with our franchisees, we look for ways to protect restaurant profitability via productivity efforts and selective price increases. These price increases disrupted long-running value programs and led consumers to reconsider their buying habits.” This has sparked MCD to bring back their “value” meals to relief price pressures from consumers.

Ford (F): “We also see excess capacity that will lead to more pricing pressures.”

Potbelly (): “But there is softness that we see in traffic as well…So we have another price increase planned for Q3, but honestly, we’re contemplating whether or not we need it at all as we want to continue to kind of support the business and meet the customer where they are.”

Disney (DIS): speaking of the parks business, “And we talked about the fact that the lower-income consumer is feeling a little bit of stress. The high-income consumer is traveling internationally a bit more. I think you’re just going to see more of a continuation of those trends in terms of the top line.”

This is just a small, anecdotal smattering of company comments, but are helpful to paint the picture of slowing pricing power. This trend in prices could have important implications for the pace of earnings growth going forward, mostly in comparison to current consensus expectations.

“If That’s Your Best, Your Best Won’t Do”: Earnings Implications of Slower Pricing Power

One of the most critical dynamics of the last four years is that higher inflation has been a boost for corporate profits and margins.

Higher economy-wide inflation gave companies the air cover to raise prices and pass on their own cost increases to end customers. But overall metrics show that companies had greater benefits from price increases than just passing through costs (thanks to contribution margin dynamics).

The chart below shows in the green circle how, as inflation surged in 2021-2022, revenue growth also surged, coinciding with a jump higher in operating margins and, thus, overall earnings growth. Yes, inflation was a pain for companies, but it also was a boon for earnings.

The fall in margins in 2023 is also an important dynamic: margins fell in 2023 because revenue growth was normalizing as the rate of inflation fell. Part of 2023 had an “earnings recession”, with earnings growth turning negative, not because the economy was experiencing a recession, but because margins were normalizing back to sustainable levels.

The fascinating point about this chart is seen in the red circle. The gray line represents current consensus forecasts for 2025 operating margins. Note the huge surge up to new all-time highs that is already being baked in to 2025 EPS estimates. This forecast implies that either inflation, pricing power, and revenues surge higher in order to drive margin expansion or that U.S. corporate earnings experience a meaningful surge in productivity.

Productivity by U.S. companies is certainly not something to bet against, but it is a high bar for companies to jump over just to make consensus estimates, let alone surprise to the upside.

On the inflation, pricing, and revenue front, it is important to note that, despite moderating headline inflation readings, companies are still experiencing input cost inflation. The challenge is that they appear to have less ability to pass these cost increases on to consumers.

This dynamic is captured in the following chart, which shows ocean shipping costs and durable goods inflation (durable goods are items like washing machines, cars, and furniture). In 2020-2021, as shipping costs soared on supply challenges, durable goods prices rose rapidly. As input cost inflation moderated in 2022 and 2023, durable goods inflation also moderated, going into and staying in outright deflation (a negative reading) since the start of 2023.

But note the dynamic of 2024, shipping costs are rising rapidly, but durable goods are slipping deeper into deflation. There are of course far more cost inputs in durable goods manufacturing than just shipping costs, with relief in some inputs like commodity prices. However, for a company like Whirlpool (WHR), the inability to raise price despite still-sticky input costs has translated to operating margins getting cut in half since 2021.

“We’ll fight the powers that be”: Conclusion

The takeaway from this analysis is that as inflation moderates and pricing power fades, consumers and the Fed are likely to rejoice, but corporate profit margins are at risk of not reaching lofty expectations for expansion into 2025.

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC

The post We’re Not Gonna Take It: The Implications of Fading Pricing Power on Corporate Earnings appeared first on NewEdge Wealth.