You yell barracuda, everybody says, “Huh? What?” You yell shark, we’ve got a panic on our hands

– Mayor Vaughn, Jaws

Investors were reminded of a valuable lesson this week: falling interest rates can be good for risk assets but only up to a point and only for the right reasons.

While the Fed declined to reduce its target rate this week, bond markets have not waited for permission to rally, pricing in weaker growth and easier Fed policy in the near future, as jobs and manufacturing data disappointed. Treasury yields plummeted across the curve and global equities corrected sharply on growing concerns that the Fed has waited too long to ease policy in light of rising unemployment.

Fed funds futures markets now reflect a 75% chance that the Fed will cut by 50 basis points next month and continue to cut at a brisk pace thereafter, for a total of 4.5 cuts in 2024 (a far cry from the 1 cut expected as recently as April 30).

With the balance of risks clearly tipping toward slower growth, it’s now more likely that, like Jaws’ Chief Brody, “we’re gonna need (and get) a bigger rate cut”.

Hard Landing Fears on the Rise – “Show me the way to go home”

Chair Powell projected confidence about the U.S. economy in his July 31 remarks, citing low unemployment and solid consumer spending growth. We assume that Powell did not have access to Friday’s jobs data, which showed an unexpected jump in unemployment to 4.3% and a much lower-than-expected 114k addition to payrolls (vs. 175k expected, plus revisions lower in prior months).

Though 114k is not cataclysmic, or reflective of already being in a recession, the reaction to the weaker data and the Fed’s demurral on rates cuts is more an expression of concern about where the economy is headed than where it resides currently.

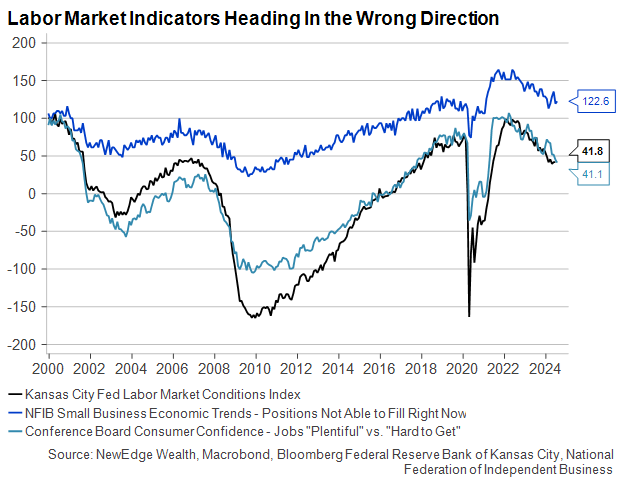

The July ISM Manufacturing survey was one of the worst in recent memory (dipping deeper into contraction at 46.8 vs. 48.8 expected), with the weak employment subindex the most concerning detail, coming in a recessionary-level 43. As the labor market goes, so will the consumer, and virtually every measure of labor market conditions has turned lower in recent months.

Business cycle indicators like the ISM have not been reliable forecasting tools in this cycle, but the subdued outlook they imply is now corroborated by disappointing labor market data. This resembles the growth scares of 2016, 2019 and 2022 but also the pattern at the start of past recessions, including 2007.

Fed – “Slow Ahead? I can go slow ahead.”

This brings us back to the Fed. Less than 48 hours after its decision to keep rates at their cycle peaks, markets already see the Fed as far behind the curve.

Whether this compels the FOMC to cut sooner or by more than 25 basis points will depend on how the data looks from here. But that it finds itself in this position at all is remarkable given that it has been barely two years since they were behind the curve in raising interest rates as inflation was accelerating.

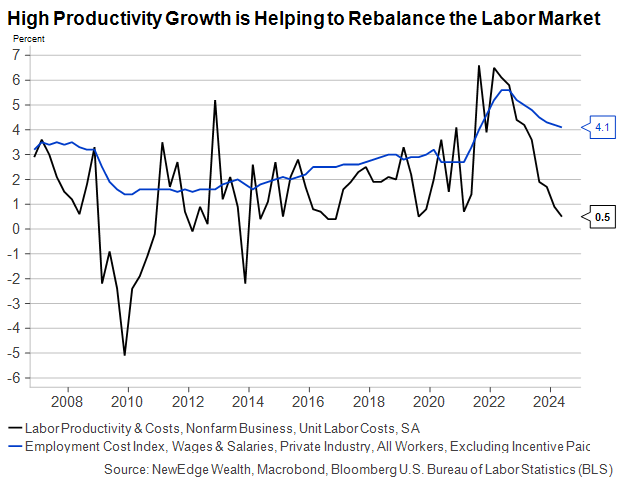

The markets’ ravenous appetite for 4.5 rate cuts in 2024 (and nearly as many again in 2025) may be hard to satisfy without signaling panic, but at the very least, the risk of higher inflation is far less likely to be a constraint for the in the coming quarters. Soft wage growth and strong productivity have conspired to short-circuit a wage-price spiral, if one ever existed, while recent earnings reports that called out weak pricing power in consumer facing businesses likely signal lower risk of a meaningful uptick in goods inflation.

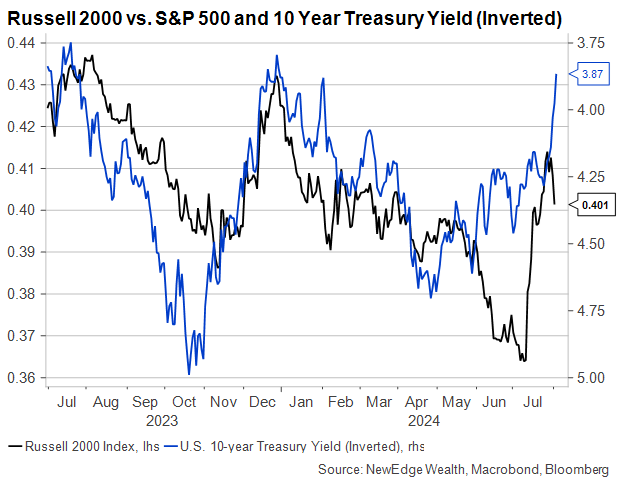

Small Caps – “Just When You Thought it was Safe”

With the 2024 landing still looking more “strange” than “soft”, the relationship between U.S. small cap stocks and interest rates has become more volatile. Fed rate cuts in a benign environment with low and stable unemployment and immaculate disinflation are completely consistent with a rally in small-cap stocks. But larger rate cuts undertaken to forestall a slowdown are not.

A phrase we have been repeating frequently over the past year of pivot hopes: rate cuts because the Fed can are great for risk assets, but rate cuts because the Fed should are bad for risk assets.

What We’re Watching Next – “You knew there was a shark out there! You knew it was dangerous!”

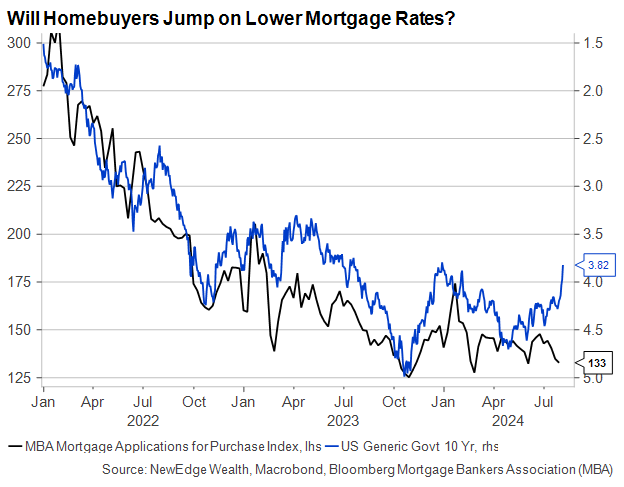

The data calendar quiets down next week, but the list of most important economic reports is rapidly changing. Our new focus will be on two series released weekly on Wednesdays and Thursdays. With the dramatic fall in long-term interest rates, mirrored by plummeting mortgage rates, we should see a jump in mortgage applications in the next week or two. If we don’t, it’s a sign that economic concerns are beginning to influence consumer behavior.

Weekly jobless claims on Thursdays will also give us a timely window into hirings and layoffs through the eyes of workers. The recent increase in continuing claims is undoubtedly correlated to the weaker JOLTS hiring rates, the rise in unemployment, and the slowing payroll growth. A further increase in jobless claims from here would indicate that August’s jobs data will probably fail to improve upon July’s.

Coughing Canaries in Credit markets – “Lifeless eyes, black eyes, like a doll’s eyes”

Up until this week, credit markets, which are typically the canaries in the economic coalmine, seemed nonplussed about the potential for weaker growth or a Fed policy error. No more.

Spreads have begun to widen, particularly for high yield credit, just as we feared might happen if rates fell alongside economic growth forecasts.

While do not expect a spike in defaults given the relative strength of corporate balance sheets compared to prior cycles, we believe investors should consider trimming credit risk in their fixed income portfolios, mostly in low quality areas. The extra yield on below investment grade bonds is not compensating holders for the additional risk they are incurring. That may change as spreads widen further, but we prefer higher rated corporate bonds as well as U.S. municipals and U.S. Treasuries for now.

Equity Market Reaction – “This Was No Boat Accident”

After an ebullient start to summer, equity markets have certainly experienced a jolt of volatility in recent weeks, with the VIX volatility index jumping to 23.4 on Friday, up from the complacent 13 level it reached in early July.

It is important to note that a big part of this move in equity markets is certainly related to growth fears, but that those growth fears are being amplified by an unwind of positioning that got extraordinarily crowded (said another way, everyone was on the same side of the boat).

Strengthening in the Japanese yen has likely caused the unwind of global carry trades, while CTA positioning entered this corrective period in the 99th percentile and Deutsche Bank’s Consolidated Equity Positioning had reached the 96th percentile. This just means that many investors were not prepared for or expecting this higher volatility.

This crowded positioning should also be noted in the context of valuations that got painfully stretched by mid-July and sentiment measures that showed widespread complacency.

From a levels’ perspective, the S&P 500 touched its 100-day moving average Friday and rebounded through the day, as shown below. If this level does not hold, the next line of support is ~5,000, near its 200-day moving average.

S&P 500 with its Relative Strength Index

Interestingly, the index is not oversold yet, whether we are looking at external measures, like the relative strength index (shown above), or internal measures like the percentage of names trading above their 50-day moving average still at 64% (shown below). This breadth measure has often gone close to or below 20% in durable bottoms.

S&P 500 with the % of Members Trading Above Their 50-Day Moving Average

Overall, we would not be surprised to see this corrective period continue. We will explore the topic in greater detail next week, but we do see risk that 2025 EPS estimates are too high, meaning there could be more recalibration of growth estimates needed, mostly in the context of recent weaker data.

Opportunities & Conclusion – “Tell them I’m going fishing.”

Whether this is a run-of-the-mill growth scare akin to 2016 or something worse, market volatility presents opportunities for investors. Our preference for segments of the equity market with high quality earnings and dividends have typically fared well during periods of equity market volatility and growth uncertainty. We would see further volatility as an opportunity to take advantage of indiscriminate selling and lower valuations in high conviction areas.

We retain a similar preference for quality within fixed income, and investors who have profited by holding large cash balances for the past few years should now expect to be paid less to own them. Taking more duration risk may help protect portfolios in the event the volatility continues and may support their bond portfolios to continue produce solid income streams. We note that longer-term yields are oversold in the short-term, so a bounce back higher in yields is certainly possible, providing an opportunity to add to longer duration positions.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC

The post We’re Gonna Need a Bigger Rate Cut appeared first on NewEdge Wealth.