Outside the Dawn is Breaking…on 2025

Our last Weekly Edge addressed the potential that we could see improving economic data in the wake of the U.S. election, reflected by more optimistic consumer and business survey responses. Since then, we’ve seen that effect materialize in some places (consumer expectations) but not others (services business sentiment).

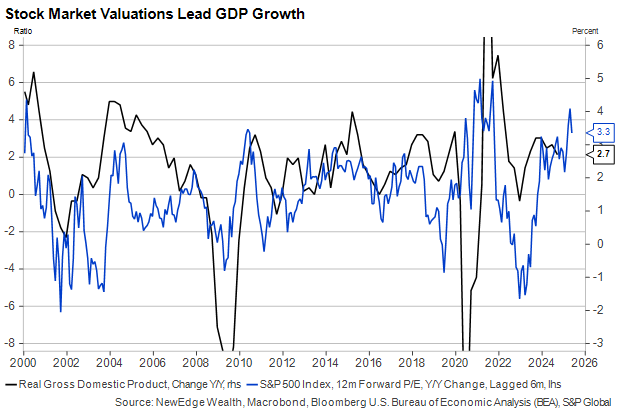

But there has been one leading indicator that has delivered a clearer verdict: The U.S. stock market. Financial markets have been among the most accurate predictors of economic growth over the past few years, reflecting a far stronger economic scenario than most classic economic forecasters expected. Today, financial markets are still sending a message of optimism, so should we be like Freddy Mercury and face 2025 with a grin?

As the chart above shows, rising equity valuations today tend to mean stronger GDP growth tomorrow for reasons we will cover in this piece. But a stock market that hits new all-time highs on a seemingly daily basis is a double-edged sword. It bolsters confidence among asset-rich consumers even as it diminishes the likely forward returns those consumers will receive over the long run.

The lyrics to Queen’s haunting classic, “The Show Must Go On,” remixed to even more dramatic effect by Jim Broadbent and Nicole Kidman in 2001’s Moulin Rouge!, encapsulate the relationship we see between stocks and the macro picture as we form our 2025 outlook. In short, a significant pullback in stocks may be the biggest risk to continued strong economic growth.

“My Makeup May Be Flaking” – A Soft-ish Jobs Report

The strong environment for U.S. consumers over the past…well…just about any number of years owes to both the strong labor market and the broad rise in asset prices. But over the last year we have seen a slight softening in labor market conditions, with slower job additions and peripheral labor data like the quits and hiring rates moderating.

Friday morning’s November U.S. employment report showed a continuation of the recent gentle softening trends in job creation and overall employment. Most concerning was the drop in prime-age employment, which has fallen by 0.5% in just the past two months.

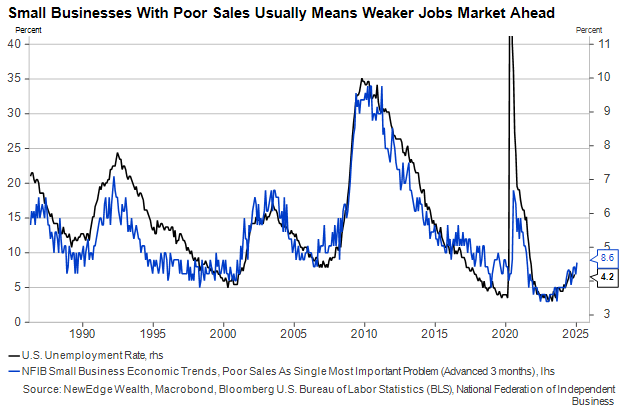

Lower employment shrinks the consumption base, which in turn discourages businesses from hiring, and the feedback loop continues. As this chart suggests, small businesses are keenly sensitive to sales weakness when deciding whether to increase headcount, making the NFIB Small Business Sales statistic below a helpful leading indicator of the overall unemployment rate.

Nothing in the November data tells us that layoffs are picking up or that consumer spending is under immediate acute threat, but if the slight softening is likely enough to ensure an interest rate cut from the Federal Reserve when it meets in a few weeks. Stock prices rose on this news, with some indexes hitting new all-time highs. And that brings us to the topic of this report.

“I Guess I’m Learning” Consumers Are Sensitive to Stock Market Moves

The November employment release provided stocks with a modest boost, but the reality is that equities were already on a tear heading into it. And that’s a good sign for the economy in 2025 (but not necessarily forward stock returns; the market is not the economy, after all).

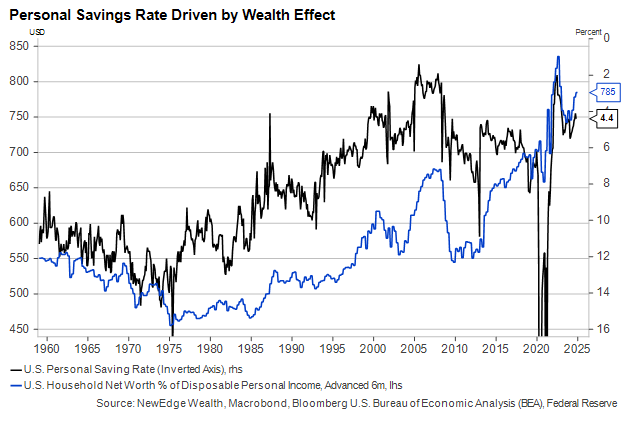

Why has the stock market historically been a good forecaster of the U.S. economy? First, high stock returns like those of the past two years foster a general sense of confidence that leads business owners and households to take more risk, leading to stronger hiring and investment. Second, the wealth effect associated with rising asset prices influences households’ spending and savings decisions.

While equity holdings are by no means distributed equally across the U.S. population, there has been an inarguable link between rising aggregate wealth (as a percent of disposable income) and the personal savings rate. As wealth has increased, the personal savings rate has declined.

Consumers Facing Headwinds as They Try to “Hold the Line” on Spending

Just as much of U.S. individual wealth is owned by a relatively small share of households, most spending is done by a relatively small share (the same share, more or less) of consumers. We can see this not only in the spending data by income level, which we’ve shown before but in the financial stress households are facing. Consider these two graphs from the Federal Reserve Bank of New York’s Third Quarter Household Debt and Credit Report.

Mortgage defaults are still vanishingly rare across all age cohorts, in stark contrast to the mid-2000s before the global financial crisis. Credit card debt, which is more sensitive to changes in interest rates, is stressing younger households almost as badly as it was leading up to the 2007-09 recession. Home ownership has become a key dividing line between the “haves” and “have-nots”, especially given the high rent inflation of the past few years.

Emerging cracks in the consumer debt picture remind us that different factors influence spending depending on the type of household. Wealthier households, disproportionately retirees, are not as affected by labor market trends but could pull back on spending if their nest eggs fell by 10% or more. Less well-off households are already feeling the pinch of slower wage growth and a looser labor market as they attempt to service their existing debt while saving little.

As lower-income consumers continue to slow their spending growth, stable asset prices take on greater importance in keeping consumption supported on the upper end. In other words, The Show (for Stocks) Must Go On.

But Are Investors in for “Another Heartache” With Stocks at Record Highs?

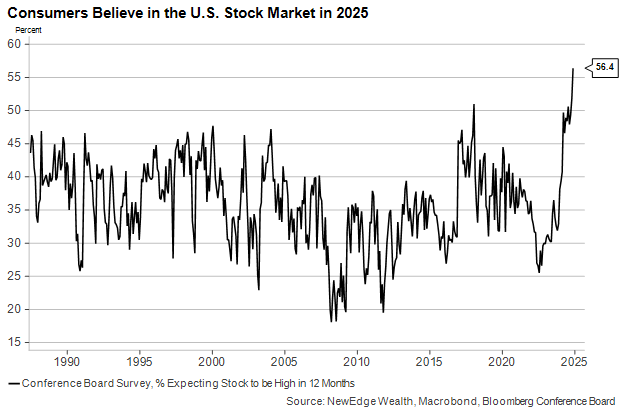

At the moment, the stock market is at an all-time high, and so is the percentage of consumers who expect it to be even higher a year from now, as seen in the chart below.

While there’s certainly risk to investors relying on “fairy tales of yesterday”, animal spirits can become their own driver (or extender) of market rallies and economic growth for indeterminate periods. These animal spirits appear today to be pricing in the promise of a new administration more supportive of economic growth and, especially, higher profits.

We’ve spent the past few months urging realism about expecting too many good things to come from public policy changes in 2025, whether it be interest rate cuts from the Fed or tax cuts from Congress and the incoming administration. One thing that has become clear since the election is that the second Trump administration will view the stock market as one of its own job performance barometers. Consensus is interpreting this to mean fewer policies that could risk short-term market pain in 2025, but this “Trump Put” hope is likely less realistic in practice given it is not just policy that impacts the path of markets.

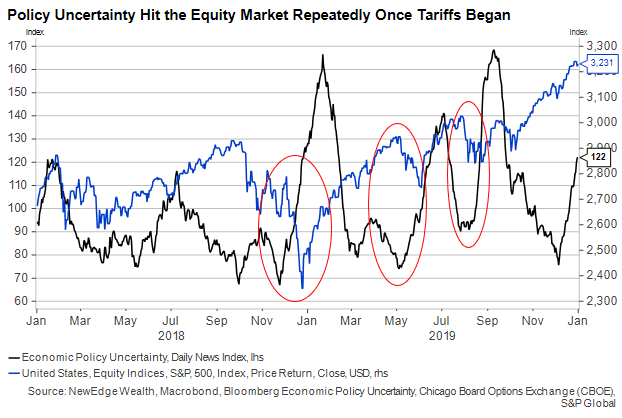

The nomination of Scott Bessent as U.S. Treasury Secretary was greeted as one such market-friendly move, as were reports of cordial conversations between Trump and his soon-to-be counterparts in Mexico and Canada so soon on the heels of his broad tariff threats last week. Rising economic policy uncertainty, centered on trade-related issues, was partly, if not primarily, responsible for multiple equity market pullbacks in 2018 and 2019. It seems the new administration would prefer to avoid a repeat of this pattern in 2025.

While the president-elect clearly believes in tariffs (at least as a negotiating tool), their deployment in significant number and impact would happen over the stock market’s vociferous objections. Holding fire on the full Trump campaign promise of 10-20% across-the-board taxes on imports would mitigate one potential market risk next year.

Of course, there are limits to how high and firm a floor politicians can place under the stock market. Fed policy remains independent and may become less supportive of frothy market conditions if rate cuts cease while balance sheet (i.e., liquidity) shrinkage continues. And whatever chances of a quick and clean passage of a stimulative tax and spending bill are priced in may be priced out once the political reality of an ultra-slim 217-215 Republican House majority sets in.

Conclusion – “Does Anybody Know What We Are Looking For” Next from Stocks?

For months, we have been describing equity and credit markets as priced for perfection while noting that valuation is not a timing tool. This means that perfection could (and, indeed, now has) become more perfect. We do not see a near-term catalyst to knock stocks off their perch, at least through the end of the year, but we are concerned that many of the investor flows in recent weeks have gone into assets with poor fundamentals, many of which are trading at astronomical valuations that are likely to (at some point) crash back to earth.

The current environment bears some resemblance to the Tech Boom of the late 1990s and early 2000s, during which a minority of stocks took the S&P 500 into bubble territory and back. At the peak of that mania, the wise course was to diversify into parts of the market that had not fully participated in the run-up. Investors who moved out of expensive, concentrated positions avoided seeing their assets fall by the full 50% that most major indexes ultimately lost. If the junky rally that “tops the bill” today becomes “overkill”, investors must still “find the will to carry on”. On with the show!

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC

The post The Show Must Go On appeared first on NewEdge Wealth.