We spies

We slow hands

Put the weights around yourself

“Slow Hands”, Interpol

The narrative ping pong continues.

In the span of a mere two weeks, the market has gone from expecting a dire outcome of sharply weakening growth and the need for aggressive Fed easing (very Paul Banks-esque) to today’s view that growth is remaining resilient, even while inflation continues to moderate.

What sparked this narrative shift was two consecutive drops in initial jobless claims and a better-than-expected July retail sales report. Together, these ran counter to the “imminent demise” and “emergency cuts” calls that proliferated just 10 days ago. Despite the pleas and pricing for swift action to resolve being behind the curve, it’s now more likely the Fed will move with “Slow Hands” as it begins to ease policy in September.

“You Know Not Yourself”: Judging Jobs and Spending Data

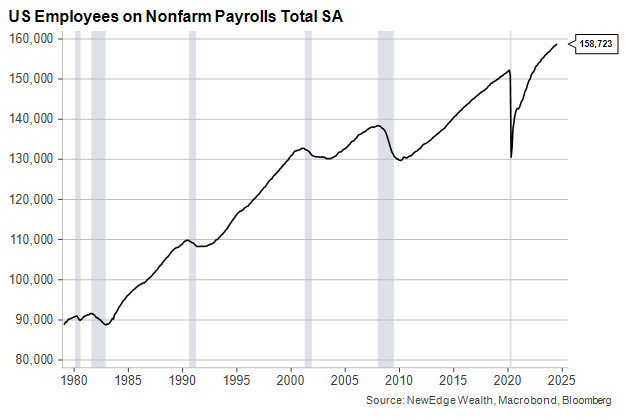

Back when the divergent Household and Establishment surveys in May’s jobs report painted very different pictures about the state of the U.S. jobs market, we argued that the best way to judge the health of the jobs market is to judge the health of consumer spending. That remains true today. If consumers are making money, they will spend money, so any serious erosion in the job market would show up in fraying consumer spending.

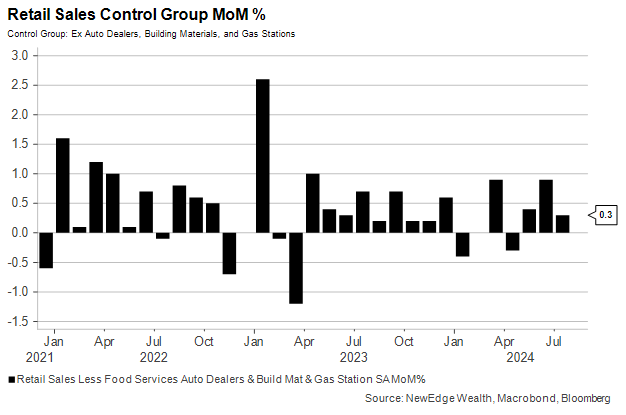

July’s resilient retail sales data (Headline +1.0% vs. +0.4% consensus, Control Group +0.3% vs. +0.1% consensus, ex Auto and Gas +0.4% vs. +0.2% consensus) suggests that the U.S. jobs market is not collapsing and that consumers still have the willingness and ability to spend.

Of course, any statement about consumer strength requires nuance, mostly in the context of a U.S. consumer experience that is growing increasingly bifurcated.

As we wrote last week, it is difficult to talk about “the” U.S. consumer, given the vastly different sentiment and spending power of high and low-income consumers. U.S. consumer-facing companies are sounding the alarm about low-income consumers’ increasing financial stress.

Based on commentary from the second quarter earnings season, consumers are trading down to lower-end brands and being “choiceful” in their spending, as Walmart (WMT) has dubbed it. In fact, WMT was able to beat earnings estimates and raise forward guidance this week, as customers turned to WMT to spend and save on essential items. Given what we heard from discretionary companies that are struggling with budget-constrained consumers, like Disney and airlines, their loss appears to be WMT’s gain.

Encouragingly and importantly, though, WMT had this to say about its customers: “We are not seeing any incremental fraying of our customers’ financial health.”

And so, it appears that consumers may not be going “crazy like the good old days” with their spending, but that there is still enough resilience in the job market (though a lagging indicator, overall employment is still at a record high, after all) to support continued consumption growth.

“You Put the Weights All Around Yourself”: Fed Reaction

This week’s resilient consumer data and mostly benign inflation reports support the Fed’s “patient” approach to rate cuts as risks to its outlook move into greater “balance.” Some FOMC members who had been reluctant to sound the all clear on inflation now seem resolved to begin cutting rates in September.

Atlanta Fed President Raphael Bostic commented on Thursday that he was “open” to a rate cut in September, just two days after saying he needed to see more data before endorsing one. Things change fast, even for central bankers.

The door is now wide open for the Fed to “normalize” policy as inflation has moderated, but labor market data does not suggest they need to move with urgency to stabilize a rapidly deteriorating economy.

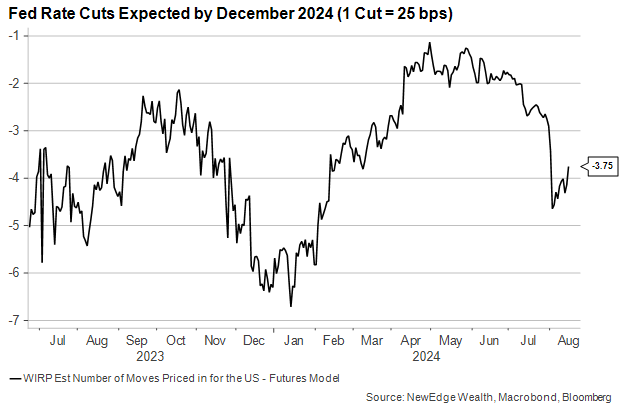

The market agrees, as the chance of a 50bps cut in September moved from a virtual certainly two weeks ago (including some possibility of an emergency cut) down to just a 29% chance today.

The combination of solid growth data and softer inflation data, namely the July CPI and PPI inflation reports, should allow the Fed to cut with “Slow Hands”, possibly forgoing the super-sized 50 bps cut and sticking to 25 bps cuts at each meeting, for a total of 3 cuts (or 75 bps) in 2024.

We also see the Fed as wanting to avoid looking like they are once again behind the curve and having to move with haste, meaning if they do not have to rush rate cuts, they will not want to.

It is notable, however, that even after the July Retail Sales report, markets are still pricing in a good chance of a 50bps cut in at least one of this year’s three remaining meetings. This likely reflects lingering concerns that the data could turn worse between now and the end of the year, forcing the Fed to act more quickly.

There are notable data points that warrant some caution about the consumer and their forward spending prospects, such as credit delinquency data and housing data, the latter of which we will unpack in next week’s Weekly Edge.

“We Rejoice Because the Hurting is So Painless”: Market Reactions

Risk assets have responded to this reversal of growth fears with a certain “rejoice” (apparently because the rate hike “hurting is so painless” when it comes to the jobs market, for now…).

Equities and credit have rallied, even as bond yields have partially rebounded on expectations for a slower path forward for Fed rate cuts.

This is a great reminder that equities have cared much more about the growth outlook than the Fed outlook for the last 18 months, taking the pricing in of a tighter Fed in stride (such as the strong equity rally in 1H24 even as rate cut expectations for the year went from 6.5 to 1 cut), while getting thoroughly spooked by weaker growth data (such as the weaker July payrolls data from two weeks ago that sparked the worse equity unwind of the year as rate cut bets soared).

Equity market leadership was also dominantly risk-on and pro-cyclical on Thursday in reaction to allayed growth fears. Small cap benchmarks like the Russell 2000 index outperformed, as seen below.

Russell 2000 Absolute (Top) and Relative to the S&P 500 (Bottom)

Recall that we see two necessary conditions for sustained small cap outperformance: lower yields and resilient growth. Lower yields help to relieve balance sheet pressure from highly indebted small cap companies, but if yields are falling because of weaker growth, small cap’s acute economic sensitivity and typical earnings volatility will likely cause renewed underperformance. This means both conditions, lower yields and resilient growth (effectively a soft landing), have to happen in tandem.

Looking at bond markets, one of our key observations from the market swoon two weeks ago is that bond yields got so aggressively oversold (yields went down too far, too fast), that they were primed for a snap higher if data did not confirm the collapsing growth narrative. This is what we have seen playout in response to Thursday’s weaker data as yields jumped, especially at the short end of the curve.

We see yields remaining in a downtrend in the medium term but could see a very near-term bounce higher in yields out of the oversold condition and up to overhead resistance (such as the 50-day moving average on the 10-year yield currently at 4.18%). A bounce higher in yields could provide an entry point for investors looking to extend duration in fixed income.

U.S. 10 Year Treasury Yield with Relative Strength Index

U.S. 2 Year Treasury Yield with Relative Strength Index

“See the Living That Surrounds Me”: Conclusion

This will certainly not be the last backspin of this game of narrative ping pong that has whipsawed market pricing (and Fed commentary, for that matter).

We continue to see the U.S. economy as slowing but with an underlying resilience that keeps us from expecting an imminent recession. We see the data as giving the Fed room to begin normalizing policy but do not think they will do so with urgency. However, we would note that we see a greater risk of growth disappointing to the downside rather than inflation disappointing to the upside. We see the data as being volatile with the potential for sharp changes (a key characteristic of our “Strange Landing”), meaning we will continue to be highly attuned to signs of deterioration in the data that could raise the forward probability of a recession.

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC

The post Slow Hands appeared first on NewEdge Wealth.