In the grand ranking of defeated and desperate pleas for love and acceptance, Fräulein Sally Bowles’ haunting “Maybe This Time” at the end of the first act of Cabaret takes the cake (we are partial to Natasha Richardson’s rendition from the 1998 revival).

In a close second comes Value stocks in 2024. Defeated, desperate, unloved, unaccepted, the Value factor/style might as well apply to jobs in the chorus line at the Kit Kat Club.

But even Sally, the “Toast of Mayfair”, has some hope for the future, assuring herself that “it’s gotta happen, happen sometime”, so can Value stocks have similar hope as we turn the calendar into 2025?

Today’s Weekly Edge will examine Value’s setup vs. Growth in 2025 as we explore the ever-persistent question of maybe, this time, Value will win.

Our conclusion is that Value stocks are primed for a potential snapback in relative performance, possibly to start 2025 given extreme Growth outperformance in recent weeks. But the durability of this Value snapback/rotation in leadership, remains a “show me story”, with Value’s relative earnings versus Growth stocks being the key determinant of how long the rotation could last. Without an improvement in the recent trend of negative Value earnings revisions, the resurgence of Value will be just as fleeting as Sally Bowles’ “Perfectly Marvelous” happiness (but you can still paint your nails green if you think it’s pretty).

Note: All references to Value and Growth are to the Russell 1000 Value and Growth indices, using Bloomberg data as of 12-13-24 unless otherwise noted.

“Everybody Loves a Winner, So Nobody Loved Me”: Value’s Tough Two Years

Since the beginning of 2023, the Russell 1000 Value has lagged the Russell 1000 Growth index by a whopping 60%.

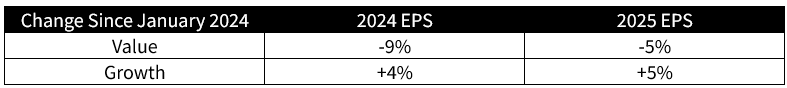

If we deconstruct the source of Value and Growth’s performance, we can see that Growth’s dominance has been fundamentally driven, meaning Growth dominance has been more than just AI hopes and dreams. As the table below shows, Growth has enjoyed far more valuation expansion than Value over the last two years, but Growth has also delivered more than 3x the earnings growth versus Value.

There is an important contrast from this recent Growth dominance in both performance and earnings to a year like 2022, where Value did significantly outperform Growth by 20%. In addition to Growth’s valuations having much further to fall versus Value in 2022 (Growth started the year trading at 30x, double the valuation of Value!), Value delivered superior earnings growth in 2022, with forward EPS for Value +8% vs. Growth’s flat forward EPS.

This superior earnings growth for Value largely came from the Energy sector’s over 180% growth in forward earnings that year, but there was also the dynamic of weaker mega-cap tech earnings in 2022 due to the pull forward of growth and overspending that happened in the aftermath of the pandemic.

Bringing it back to today, the inferior earnings growth of Value vs. Growth over the last two years has been exacerbated by a relentless earnings revision downcycle for Value that has constantly dashed hopes that Value could have a sustained resurgence.

Looking to 2025, the market expects Growth earnings to outperform Value earnings once again, with +16% growth for Growth in 2025 vs. +11% for Value. As we mentioned above, this Value EPS estimate is a bigger “show me story,” given the persistence of negative earnings revisions that have plagued the Value index.

It is good to remember that these weaker earnings and earnings revisions for Value vs. Growth do reflect the sector composition differences of the two groups. For Value, Financials, Industrials, and Healthcare make up 52% of the index. Healthcare has seen some of the most pronounced earnings revisions lower in 2024, with the sector’s expected earnings growth for 2024 being revised down from +20% to start this year to just +3% today.

For Growth, Technology, Consumer Discretionary, and Communication (the home of all of the Magnificent Seven stocks) make up 77% of the index and have all enjoyed positive earnings revisions over the course of this year.

Speaking of the Magnificent 7, it is also important to remember that this cohort of winning stocks makes up 55% of the Growth index. As we look to 2025, one of the biggest question marks for the Mag 7 as a group is how the market will digest a deceleration in the pace of earnings growth next year. On a capitalization-weighted basis, the growth rate for the Mag 7 is expected to decelerate from 55% in 2024 to 20% in 2025, which is still a healthy, above-market pace but not nearly to the same extent as this year.

Without having to make an argument for the unwind of highly concentrated indices and Mag 7 weakness, which could very well happen in 2025 or beyond, it is reasonable to hypothesize that the pace of Mag 7 outperformance will at least slow in 2025 simply due to this earnings growth slowdown. For now, though, the pace of Mag 7 outperformance has not slowed, with the Mag 7 surging to new absolute and relative highs in recent weeks, challenging this notion of a “broadening” in market leadership.

Bloomberg Magnificent 7 Index Absolute (Top) and Relative to the S&P 500 (Bottom)

As we will show in the next section, we do think the Value index is primed for a rebound in 2025, but in order for this rebound to be sustained, it needs to be confirmed by earnings fundamentals of Value improving. This will be put to the test starting in late January’s 4Q25 earnings season.

“Well, All the Odds Are, They’re in My Favor; Something’s Bound to Begin”: The Setup for a Snapback

The chart of the Mag 7 outperformance above paints a clear picture of a market that is likely chasing leadership into year-end, not necessarily moving on fundamentals.

To see this another way, the chart below shows the Nasdaq 100’s price in white and its 2025 EPS estimates in blue. You can see clearly that falling EPS forecasts accompanied the fall in the Nasdaq in 2022, while the rise in the Nasdaq in 2023 and 2024 was supported by rising EPS forecasts. But 3 months ago, prices and earnings forecasts started to diverge, with EPS falling and prices surging.

Nasdaq 100 (NDX) Price and 2025 EPS Forecast

This divergence between fundamentals and price, along with stretched readings in relative performance and relative valuation of Growth over Value suggests that we are primed for a snapback in Value and other left-behind performance, potentially to start 2025.

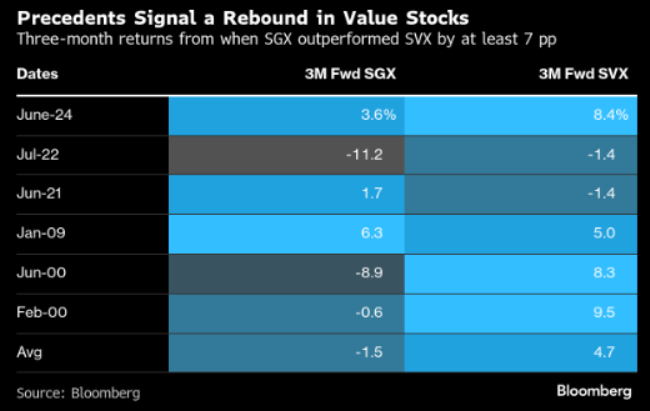

An analysis from Bloomberg’s Markets Live Blog showed that post periods when Growth outperformed Value by 7% or more, as the Growth index has recently, Value tended to have a snapback period of outperformance. The table below shows how there have only been six observations since 1995 of this degree of Growth over Value dominance, with the average returns post these periods pointing to better Value returns, even if just for 3 months.

We have also been noting that quantitative and technical analyst greats have been flagging excess returns in momentum, low quality, and beta, suggesting that Value, lagging, and high-quality areas are primed for a snapback. The former three factors are not the same as Growth, but there is a fair amount of overlap between these factors and the Growth index.

- RenMac’s Jeff DeGraff flags that high beta is in the 99th percentile of excess returns, a reading that suggests that beta could give back some of its recent outperformance.

- Adam Parker of Trivariate is calling for an unwind in high beta and junk rallies (which have had 15% outperformance in the last 3 months, a sign of extreme risk-taking) in favor of higher-quality stocks.

- Empirical’s Rochester Cahan notes that momentum has outperformed by 23% in the last twelve months, putting this reading in the top 3% of the last 70 years, suggesting that momentum could be primed to underperform in the near term.

Overall, we do not view the straight line up in Growth vs. Value performance over the last month as sustainable, mostly into 2025 (seasonality into the end of the year, where the “winners keep on winning” could, in theory, prolong this longer than the laws of gravity would normally suggest).

Russell 1000 Growth vs. Value Indices

“Lady Peaceful, Lady Happy, That’s What I Long to Be”: Conclusion

Clifford Bradshaw’s Sally Bowles in Cabaret character is said to: “represent the people who kept their eyes shut to changes in the world around them.” As analysts, we do not want to be like Sally Bowles, instead we want to keep our eyes wide open to changes in the world in order to find ways to adapt.

The outlook for Value vs. Growth is balanced between the short-term setup for a snapback in relative performance but lingering uncertainty about the ability of this snapback to be sustained given Value’s murky earnings outlook vs. Growth.

We will keep our eyes open to changes in the earnings trajectory for Value and continue to ask on poor Value’s behalf, “Maybe this time?”

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC

The post Maybe This Time appeared first on NewEdge Wealth.